Page 2 of 4

Re: Fourth Turning aligning with Elliott Wave Supercycle?

Posted: Sat Jul 09, 2022 9:00 am

by Phong Tran

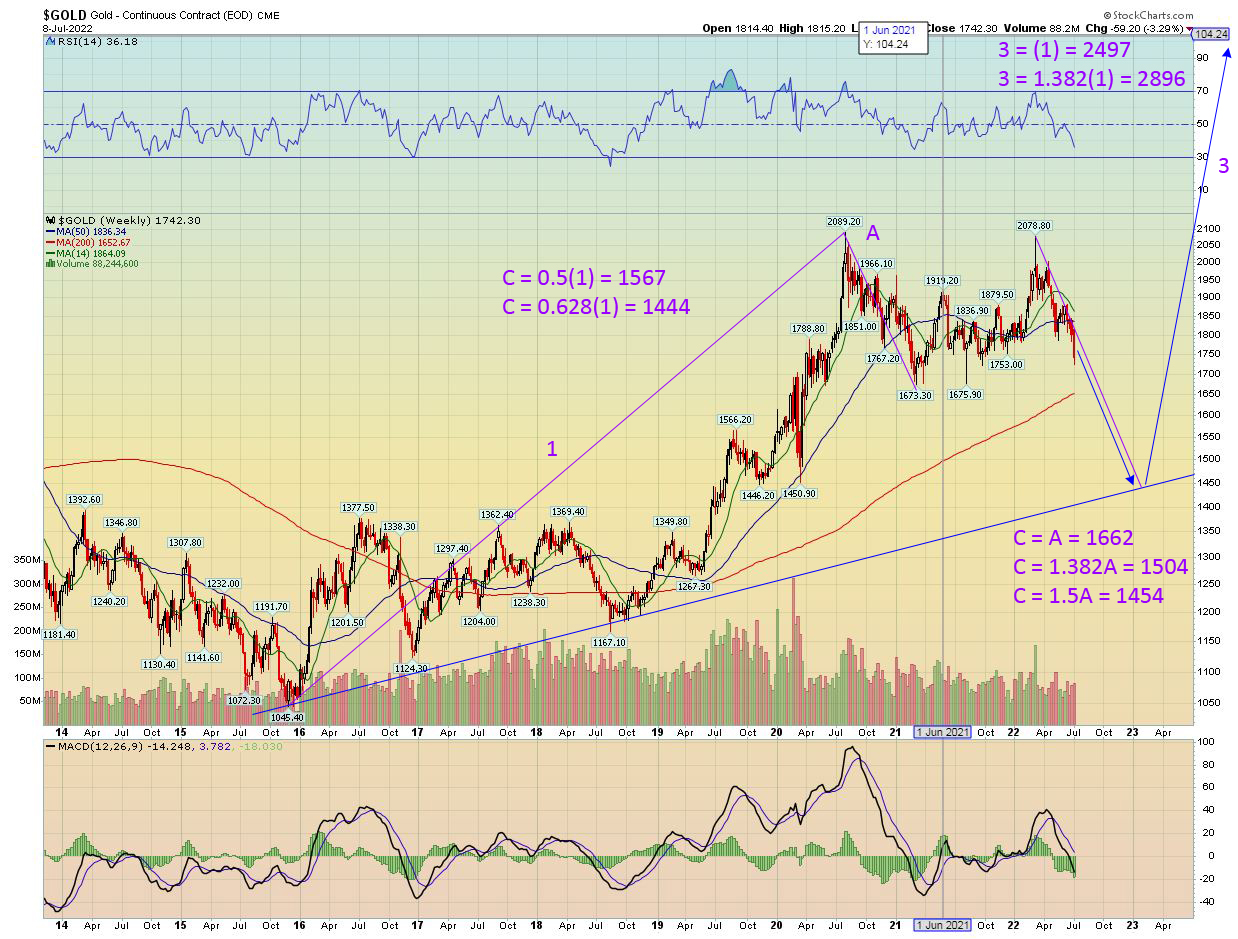

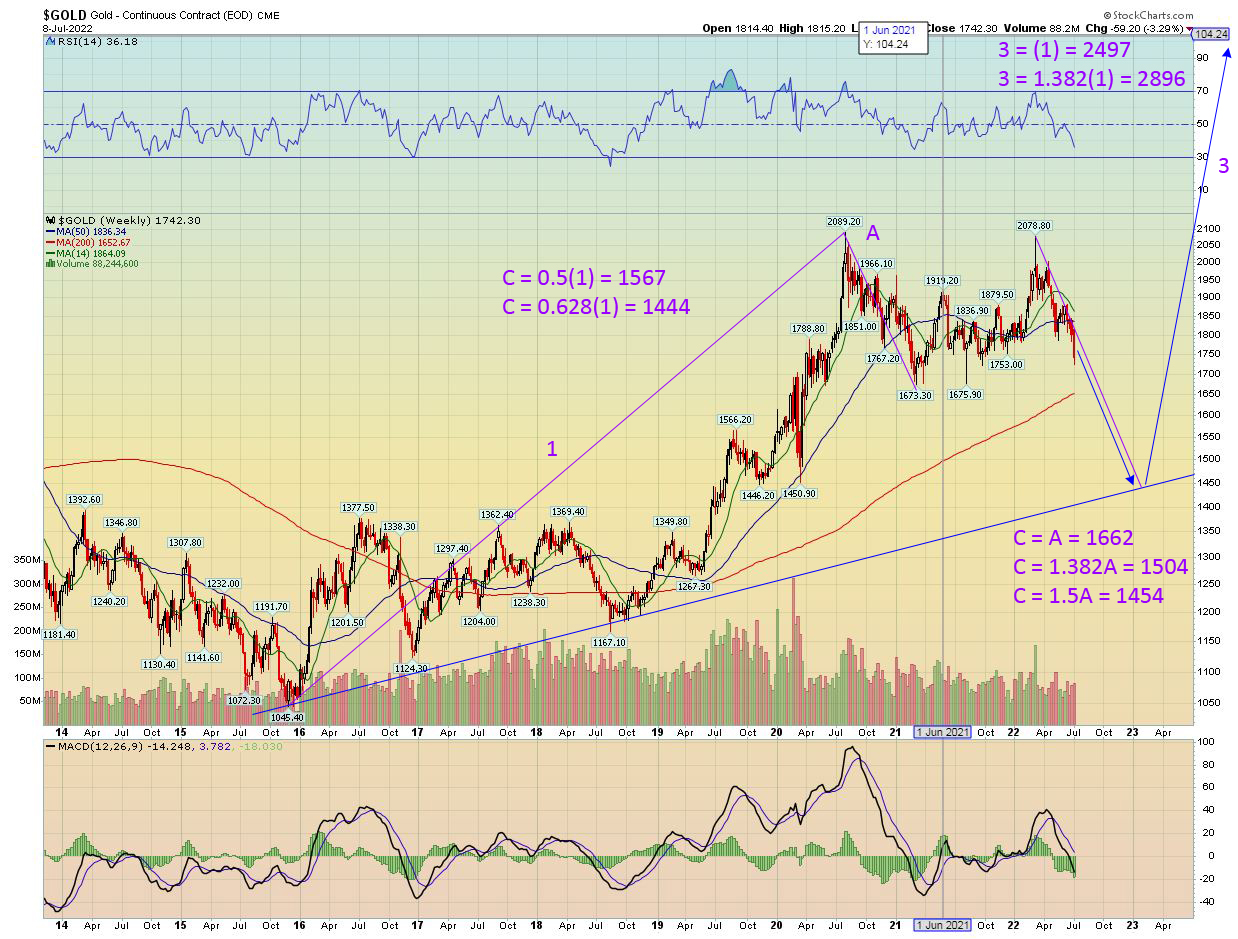

Expecting a larger correction in Gold, around $1500 +/- $50. This would coincide with the USD strengthening towards 120 as asset deflation takes hold with the Fed interest rate hikes. A lot of gold bugs were riding on hope of the cup and handle pattern being the launchpad towards $2500 which is why I don't think it will be. Gold will naturally retrace between 50% to 62.8% of the runup from (1) before continuing on.

Gold doesn't live in a bubble, just like crypto and everything is interconnected.

My thoughts are with you John, praying for the best outcome.

[edit] chart should read 0.618(1) but the math is correct

Re: Fourth Turning aligning with Elliott Wave Supercycle?

Posted: Sun Jul 10, 2022 9:17 pm

by John

Thanks to you and others who have wished me well.

Re: Fourth Turning aligning with Elliott Wave Supercycle?

Posted: Sun Jul 10, 2022 9:59 pm

by Trevor

Welcome back, John!

Re: Fourth Turning aligning with Elliott Wave Supercycle?

Posted: Wed Jul 13, 2022 10:37 pm

by DaKardii

John wrote: ↑Sun Jul 10, 2022 9:17 pm

Thanks to you and others who have wished me well.

You're welcome. How're you doing, John?

Re: Fourth Turning aligning with Elliott Wave Supercycle?

Posted: Sat Oct 01, 2022 8:12 am

by Phong Tran

Just playing around with some counts and thoughts for SPX, DXY, WTIC and GOLD between now and March 2023. We know after the full wave 1 of III finishes that we should have another bear market rally before the final plunge of wave 3 of III. I suspect the wave 2 of III will be from November to December to close the year as DXY weakness pushes up the market, mid-term election hopes, the slowing down of interest rate hikes by the Fed could feed some hope that they may be forced to pivot sooner, and as the economy gets worse, bad news will be good news again, again providing the misguided belief of a pivot sooner.

After that, the rug will be pulled, coinciding with a last C wave drop for both Gold and Oil which will soon bottom before rebounding strongly. Up until then, both Gold and Oil declined along with the market due to recession fears and demand destruction, but all that will change in March when China initiates their operation against Taiwan. This may even precipitate the drop in January as logistically, they would need to start troop and equipment movement which would be hard to hide. Around this time, Gold, Silver and Oil will start their separation from the general markets and the next commodities bull market will be kicked off.

I don't believe China will do anything in October - November of this year as there are more pros than cons to waiting. The US and NATO continue to waste their resources in Ukraine, and the energy crisis in Europe has only started and hasn't filtered fully into their economy yet. Japan is having their own currency issue as well. The more their citizens suffer, the more divisiveness between their leaders and their population, resulting in less national unity and morale. Thus, by the time China makes it's move, the public outage that would normally occur would be more muted as people no longer care about other countries when they're suffering themselves.

This is me trying to reconcile the wave counts and the macro events that could align with them.

- If you want to make God laugh, tell him about your plans

*** arrows are for general direction and do not reflect price ranges or time duration

Re: Fourth Turning aligning with Elliott Wave Supercycle?

Posted: Mon Oct 03, 2022 11:41 am

by Cool Breeze

How long does the last blow off top happen next year before the big leg down for several years?

Re: Fourth Turning aligning with Elliott Wave Supercycle?

Posted: Mon Oct 03, 2022 9:45 pm

by Phong Tran

Cool Breeze wrote: ↑Mon Oct 03, 2022 11:41 am

How long does the last blow off top happen next year before the big leg down for several years?

Do you mean the current up arrow on the S&P chart between Feb-Mar? It could even be shorter, probably only really lasting a week or two. Unless you meant something else, sorry the question is slightly confusing to me.

Re: Fourth Turning aligning with Elliott Wave Supercycle?

Posted: Mon Oct 03, 2022 11:33 pm

by Cool Breeze

Phong Tran wrote: ↑Mon Oct 03, 2022 9:45 pm

Cool Breeze wrote: ↑Mon Oct 03, 2022 11:41 am

How long does the last blow off top happen next year before the big leg down for several years?

Do you mean the current up arrow on the S&P chart between Feb-Mar? It could even be shorter, probably only really lasting a week or two. Unless you meant something else, sorry the question is slightly confusing to me.

No, how long does the upward trend last after March?

Re: Fourth Turning aligning with Elliott Wave Supercycle?

Posted: Tue Jun 20, 2023 11:55 am

by khizar123

At present with the Dow at 30 500 and Gold at 1830 it takes 16.67 ounces of gold to buy the Dow. If you look at a 100 year chart there has been a low of 2 and a high of 102 ounces to buy the Dow

What are your projected values for the Dow index and the price of gold when you say they will meet at $ 5000

.

Re: Fourth Turning aligning with Elliott Wave Supercycle?

Posted: Wed Jun 21, 2023 2:59 pm

by Cool Breeze

I think we met a top, Phong. All down from here.