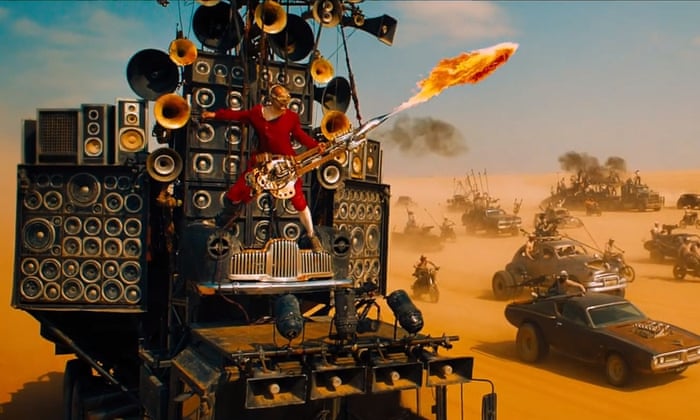

Looking at it again, if you absolutely need that much amplification, you may want to increase the range of the weapon.Bob Butler wrote: ↑Fri Feb 26, 2021 9:18 amAre you particularly good at building and using flamethrowers and guitars? You may have to have lots of patience waiting for the collapse, and use the time to build your instrument, weapon and mobile amplifier. I personally think you might better spend your time.guest wrote: ↑Thu Feb 25, 2021 5:20 pmWhen the world collapses, can I be the guy playing the flamethrower guitar?

Generational Dynamics World View News

- Bob Butler

- Posts: 1490

- Joined: Wed Jun 10, 2020 9:48 am

- Location: East of the moon, west of the sun

- Contact:

Re: Generational Dynamics World View News

-

Guest

Re: Generational Dynamics World View News

The Fed saved the world last year by promising to buy unlimited amounts of bonds and corporate debt which saved companies around the world due to this nasty pandemic. The Fed does not need to do this now and hopefully will not make the same mistakes has Japan and the EU. Higher long term bond yields are a reflection of the economy taking off. It also allows banks to make money on lending and so there will be increased lending due to higher bond rates.

The main casualty will be the overpriced tech stocks like Tesla who are at a level which is beyond the imagination and Bitcoin. Assets prices in general will fall but the economy is saved and the real economy stocks like banks, shops and miners will benefit. The EU and Japan need long term bond rates to rise to encourage banks to make money and lend but the countries are so badly in debt (not Germany) that they will not be able to afford to pay the higher interest rate.

The UK is not has indebted and the debt we do have is the longest duration of any country in the world so we are not as effected if long term gilt rates go up. Europe and Japan are in serious trouble because they can't afford long term rates going up but banks will not lend to businesses or consumers so growth rates will be limited unless they can export to the US. Again it is the American's who save the EU not the incompetent Europeans.

The main casualty will be the overpriced tech stocks like Tesla who are at a level which is beyond the imagination and Bitcoin. Assets prices in general will fall but the economy is saved and the real economy stocks like banks, shops and miners will benefit. The EU and Japan need long term bond rates to rise to encourage banks to make money and lend but the countries are so badly in debt (not Germany) that they will not be able to afford to pay the higher interest rate.

The UK is not has indebted and the debt we do have is the longest duration of any country in the world so we are not as effected if long term gilt rates go up. Europe and Japan are in serious trouble because they can't afford long term rates going up but banks will not lend to businesses or consumers so growth rates will be limited unless they can export to the US. Again it is the American's who save the EU not the incompetent Europeans.

-

Guest

Re: Generational Dynamics World View News

All central banks have been following the Fed. That is why the economic crisis is global. Much of what has happened and is happening can be laid at Greenspan's door when he bailed out LTCM and introduced the notion of too big to fail.Propping up egregious failure instead of following old practices where businesses were performing well would salvage what was worth saving from those facing bankruptcy; badly performing businesses would go on needing ever growing support from the central bank as they were in too bad a shape to save. Thus the Fed helped to create zombie companies whose lives could be saved only by transfusions of freshly created dollars.Guest wrote: ↑Sun Feb 28, 2021 6:29 amThe Fed saved the world last year by promising to buy unlimited amounts of bonds and corporate debt which saved companies around the world due to this nasty pandemic. The Fed does not need to do this now and hopefully will not make the same mistakes has Japan and the EU. Higher long term bond yields are a reflection of the economy taking off. It also allows banks to make money on lending and so there will be increased lending due to higher bond rates.

The main casualty will be the overpriced tech stocks like Tesla who are at a level which is beyond the imagination and Bitcoin. Assets prices in general will fall but the economy is saved and the real economy stocks like banks, shops and miners will benefit. The EU and Japan need long term bond rates to rise to encourage banks to make money and lend but the countries are so badly in debt (not Germany) that they will not be able to afford to pay the higher interest rate.

The UK is not has indebted and the debt we do have is the longest duration of any country in the world so we are not as effected if long term gilt rates go up. Europe and Japan are in serious trouble because they can't afford long term rates going up but banks will not lend to businesses or consumers so growth rates will be limited unless they can export to the US. Again it is the American's who save the EU not the incompetent Europeans.

The disastrous mismanagement is their sole responsibility. Their flirtation with the pointless irrational negative rates is the ultimate demonstration of a failure to be willing to administer a dose of sound economic reasoning to a reverse their patently spurious nostrums in the area of bonds and other financial instruments.

One thing is very very clear, the savings of people has been exposed to devastating damage with declining interest rates without it having any noticeable effect on national economies at large.

When it all collapses into a depression it will be far,far worse than 1929.

-

Guest

Re: Generational Dynamics World View News

The UK is just as bad as the United States. The Bank of England has rigged bond markets with the same enthusiasm as the Federal Reserve.The UK is not has indebted and the debt we do have is the longest duration of any country in the world so we are not as effected if long term gilt rates go up. Europe and Japan are in serious trouble because they can't afford long term rates going up but banks will not lend to businesses or consumers so growth rates will be limited unless they can export to the US. Again it is the American's who save the EU not the incompetent Europeans.

Instead of just QE bond-buying, the B of E is now printing money to help our government pay its bills.

Investors and speculators needed lots of QE to ensure bond prices rose over time due to artificially created demand. That gave them a reasonable return on their investment. However, with interest rates at practically zero, there's no more leg room unless we have disastrous negative interest rates. Sensing higher inflation, bond holders are selling.

If central banks lose control of the humungous debt bubble and interest rates are forced up, we're in serious trouble. Look no further than Turkey so see how it might end up.

-

Guest

Re: Generational Dynamics World View News

Being a finite resource is not the point. Yes, you can mine gold and actually there is plenty of it, but it will cost you upwards of $1000 oz to produce even after you have found some. That's how it works, inflation goes up, cost of mining goes up, production falls until price of gold rises to cover the risk. The result is an immutable commodity that tracks inflation (up or down). That's why is has been around for 4,000 yrs and BTC etc won't be. NB. The only major hiatus in that history is when the Spanish found bundles of ready made gold in the Americas which temporarily destroyed the production cost and silver took over for a while.John wrote: ↑Wed Feb 24, 2021 11:58 am** 24-Feb-2021 World View: Using bitcoin to protect against wealth confiscation

- Hot chick Cathie Wood (right)

Cathie Wood, CEO of Ark Investment Management, is generating

excitement this morning because of these remarks:

-- Ark's Cathie Wood says she's still 'very positive' on bitcoin -> "Wood told Bloomberg there are "so many use cases" for

> bitcoin. "But probably, the most important use case is as an

> insurance policy around the world against confiscation of wealth.

> "And that can happen in two ways. It can happen with inflation.

> Bitcoin, I think, is the best hedge against inflation out there

> bar none, better than gold."

> Wood also said bitcoin can protect against "outright" wealth

> confiscation, for example by irresponsible governments.

> "If you think there's a 5% chance of that happening, you should

> put 5% of your portfolio long term - or your wealth - into

> something like bitcoin. You can carry the keys in your head across

> the border.""

helping the price rise back past $50,000

https://markets.businessinsider.com/cur ... 1030117456

(BusinessInsider, 24-Feb-2021)

NB. Diamonds used to work until they found out how to make them in a pressure cooker, and the trouble with land is that isn't portable. Crypto isn't even a starter.

-

Guest James

Re: Generational Dynamics World View News

U.K. banks recovered and reformed after the GFC and passed stiff stress tests.Guest wrote: ↑Sun Feb 28, 2021 7:22 amThe UK is just as bad as the United States. The Bank of England has rigged bond markets with the same enthusiasm as the Federal Reserve.The UK is not has indebted and the debt we do have is the longest duration of any country in the world so we are not as effected if long term gilt rates go up. Europe and Japan are in serious trouble because they can't afford long term rates going up but banks will not lend to businesses or consumers so growth rates will be limited unless they can export to the US. Again it is the American's who save the EU not the incompetent Europeans.

Instead of just QE bond-buying, the B of E is now printing money to help our government pay its bills.

Investors and speculators needed lots of QE to ensure bond prices rose over time due to artificially created demand. That gave them a reasonable return on their investment. However, with interest rates at practically zero, there's no more leg room unless we have disastrous negative interest rates. Sensing higher inflation, bond holders are selling.

If central banks lose control of the humungous debt bubble and interest rates are forced up, we're in serious trouble. Look no further than Turkey so see how it might end up.

EU banks never recovered or reformed. EU over regulation kills growth in a Protection Zone that is obsolete.

25% of EU GDP is in old style factories and costs 10 times the level of Asian factories. EU businesses are moving to Asia.

Many higher value EU companies are leaving the badly run EU to commerce friendly well regulated U.K., such as Unilever. The City has over 40,000 more jobs than in 2016.

EU managers focus on more power, not on economic progress. EU management skills are revealed by the EU Vaccination Scandal. Which also showed the EU is morally bankrupt as it threatened to block the export of vaccinations.

The EU is broken structurally and morally. It is lead by incompetents.

- Tom Mazanec

- Posts: 4181

- Joined: Sun Sep 21, 2008 12:13 pm

Re: Generational Dynamics World View News

Inflation Dec 2020 to Jan 2021 is 0.43%, or 5.2% per annum.

https://data.bls.gov/cgi-bin/cpicalc.pl

Is this a blip or a trend?

https://data.bls.gov/cgi-bin/cpicalc.pl

Is this a blip or a trend?

“Hard times create strong men. Strong men create good times. Good times create weak men. And, weak men create hard times.”

― G. Michael Hopf, Those Who Remain

― G. Michael Hopf, Those Who Remain

-

Guest

Re: Generational Dynamics World View News

For the last 100 years 'clever' people have been inventing ever more fiendishly complex mechanisms to make profits out of financial instruments that have less and less connection to the real world. Bitcoin being the ultimate example, being worth a fortune based purely on speculation that it will be worth an even bigger fortune tomorrow.

I doubt many people trying to keep control of this have the faintest understanding of a fraction of it. At which point the EU appoint a lawyer to run their central bank.

What can possibly go wrong?

And when it inevitably does, who going to get burnt?

Those people who created this monster in the first place and have lived the high life on the back of it, or me, who's had nothing to do with this having spent my life trying to have a reasonable career and provide the important things for my family?

I doubt many people trying to keep control of this have the faintest understanding of a fraction of it. At which point the EU appoint a lawyer to run their central bank.

What can possibly go wrong?

And when it inevitably does, who going to get burnt?

Those people who created this monster in the first place and have lived the high life on the back of it, or me, who's had nothing to do with this having spent my life trying to have a reasonable career and provide the important things for my family?

-

JCP

Re: Generational Dynamics World View News

The stats are fake. This means very little, except, perhaps, that the inflationary spike has been so high and thus noticed by the general public that it can no longer be ignored by official statistics.Tom Mazanec wrote: ↑Sun Feb 28, 2021 8:00 amInflation Dec 2020 to Jan 2021 is 0.43%, or 5.2% per annum.

https://data.bls.gov/cgi-bin/cpicalc.pl

Is this a blip or a trend?

Who is online

Users browsing this forum: Google [Bot] and 52 guests