** 20-May-2021 World View: P/E ratio, M2V, birth rate, and CPI

richard5za wrote: Thu May 20, 2021 8:35 am

> My take on the stock market based upon about 150 years of history

> is that fair value is a P/E of 18 in good times and 13 in

> difficult economic times. But the PE is currently well over 30 on

> S&P 500. History shows it always overshoots when it corrects, in

> some cases to a PE of 5 or 6. So the maths says the minimum it

> will come off is 50%. But as PE of 5 gives it a fall of 85%. Not

> over a few weeks but over a couple of years even 3 or 4 years

> What I don't know is when the fall will start or the nature of the

> initial trigger.

> The real question is identifying the assets to be invested in when

> the fall starts. US dollar, gold miners, cash in your trading

> account?

This bifurcation of the p/e ratio index into good vs difficult

economic times is very interesting. Since you've studied the history,

perhaps you could explain further what you mean by good vs economic

times, since that isn't always obvious, and how the p/e ratio relates

to them.

I'm looking at this whole issue from a slightly different angle. We

know that there was a "baby boom" after World War II, among people who

had postponed having children until after the war. The mood at that

time was that Americans were extremely afraid of WW III with the

Communists, but after America and the West had defeated the Great

Depression, the Nazis, and Imperial Japan, Americans felt confident

enough in the future of the country and the economy that people felt

that it was OK to bring children into the world.

So I'm looking at the mirror image of the Baby Boom. If an increased

birth rate was the major statistical indicator after the war, then

what were the statistical indicators before the war that led

eventually to the baby boom? These are of interest, because the same

statistica indicators should be evident today.

Higgie has mentioned the decline in birth rates. In fact, the decline

is so large that it's hard to overstate.

> "U.S. birth and fertility rates in 2020 dropped to

> another record low as births fell for the sixth consecutive year

> to the lowest levels since 1979, according to new data from the

> Centers for Disease Control and Prevention's National Center for

> Health Statistics.

> The number of births in the U.S. declined last year by 4% from

> 2019, double the average annual rate of decline of 2% since 2014,

> the CDC said in preliminary birth data released Wednesday. Total

> fertility rates and general fertility rates also declined by 4%

> since 2019, reaching record lows. The U.S. birth rate is so low,

> the nation is "below replacement levels," meaning more people die

> every day than are being born, the CDC said."

>

https://www.cnbc.com/2021/05/05/us-birt ... -says.html

So we can make the opposite observation to the one about the Baby

Boom: Americans today don't feel confident enough in the future of the

country and the economy for it to be OK to bring children into the

world.

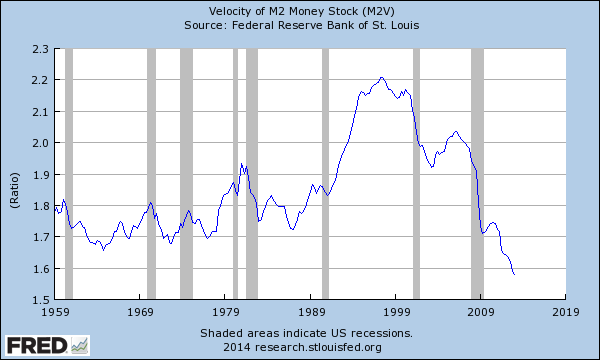

The velocity of money is poorly understood by the so-called "expert"

economists, but it's another quantity that measures the confidence of

Americans in the future of the country and the economy. It crashed

significantly in the last year, matching the crash in the birth rate.

https://fred.stlouisfed.org/series/M2V

The velocity of money measures the number of times that a single

dollar bill is used to purchase goods and services produced

domestically within a year. If the velocity of money is falling, it

means that people are losing confidence in the economy, and are afraid

to spend. If it's increasing, then people are confident about the

economy.

This is related to the inflation rate (CPI, or Consumer Price Index).

If the velocity of money is high, then people are buying more and more

goods, and the CPI will increase. If it's low, then people are saving

money instead of spending it, and the CPI will remain steady, or fall

in the extreme.

So if you look at the graph of M2V in the above link for the St Louis

Fed, you'll see that the "steady state" of M2V is around 1.8, which

means that a single dollar bill is used on an average of 1.8 times

to buy something in a given year.

In the 1970s, M2V surged to 1.9 and the CPI surged to 12%. The surge

peaked in 1981, and then began to fall back to the "steady state"

value during the 1980s. During the 1980s, the CPI also began to

return to "normal."

There was a big M2V surge in the 1990s, during the halcyon days of the

Clinton administration, reaching 2.2 in 1997. Why was there no big

increase in CPI? That's good question, and suggests that there may be

a factor of "lessons learned" from the 1970s. This is something that

requires more research.

During the period 2003-2006, M2V surged again. The year 2003 was the

first year of the Fourth Turning Crisis Era, and it was the time when

the Gen-X financial engineers cam to power and created fraudulent

synthetic subprime mortgage backed securities and sold to the

generation of their fathers, whom they hated.

However, M2V began falling sharply in 2008 with the financial

crisis. By 2014 this trend was quite clear, and I wrote

a fairly lengthy article on it:

** 13-Jan-14 World View -- Plummeting velocity of money explains deflation trend

** http://www.generationaldynamics.com/pg/ ... tm#e140113

This is the graph that I included with that article:

- Velocity of Money (M2V), 1959-2013 (St. Louis Fed)

So it was clear in 2014 that the velocity of money had been falling

sharply since the financial crisis. By 2013, it had fallen to 1.5

from its "steady state" of 1.8. This indicates how Americans were

losing confidence in the economy. And this was also the time when the

birth rate began falling. By this time, any significant increase in

the CPI really was mathematically impossible, given the falling values

of velocity and birth rate. So M2V, CPI and birth rate have a lot in

common.

Another reason why the birth rate is related to the CPI is that one of

the major reasons that people spend money on consumer goods is because

of their children -- diapers, bigger houses, etc. So a birth rate

decline signals a stable CPI and a fall in M2V.

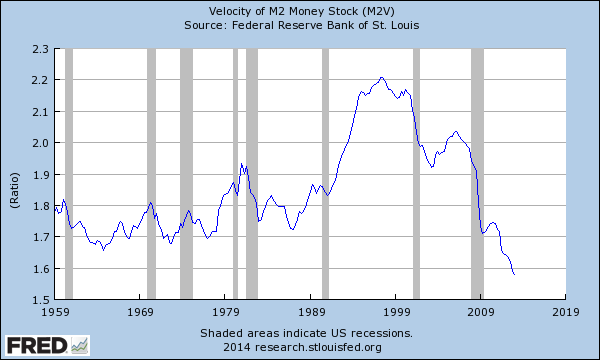

If you look at the current version of the M2V graph, you'll see that

M2V continued falling since 2013, and then began crashing

significantly starting in Q1 2020, at the start of the Wuhan

Coronavirus Pandemic. This was also the time when the birth rate

decline turned into a birth rate crash.

So I'm bemused by the present day hysteria over inflation. As anyone

with half a brain can see, any major surge in inflation is almost

mathematically impossible. If people are so afraid of what's coming

that they won't have children, then they won't have any need to spend

more money than usual, so the CPI will remain steady.

All of this should be obvious to the "experts" and "economists"

on CNBC, Bloomberg, FBN, and elsewhere. But these people are

idiots. As I pointed out in the past, they have no clue

why there was a bubble in the late 1990s, why it crashed in 2000,

why there was a real estate bubble, and so forth. These people

never get anything right, except by chance.

However, the indicators that I've been discussing are quite startling.

The birth rate collapsed in the last year, and M2V has collapsed in

the last year. The CPI spiked in April, though not as much as in

September 2008, which was followed by a year of deflation. So we'll

see what happens in the coming months.

What I've written above is still somewhat tentative, and requires more

research. Serious, thoughtful contributions are welcome.

Getting back to your original observation, Richard, the P/E ratio is

astronomically high today, as it was prior to the 1929 panic. Do you

see any further relationships with the indicators I've been

discussing?