Re: Financial topics

Posted: Wed Nov 02, 2022 9:08 pm

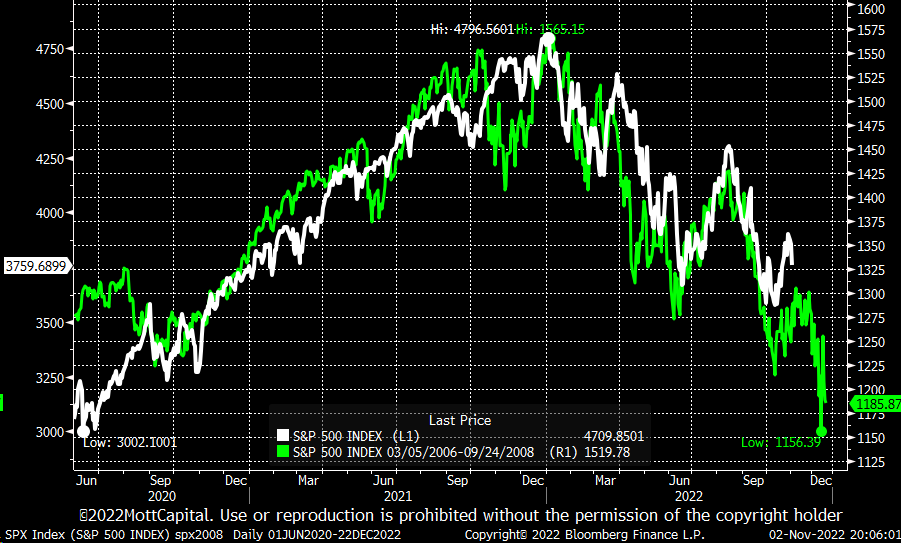

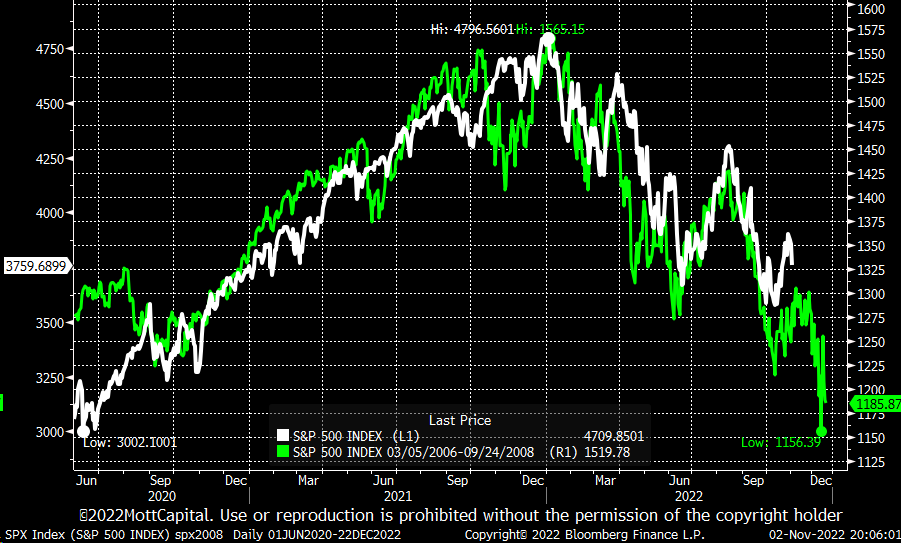

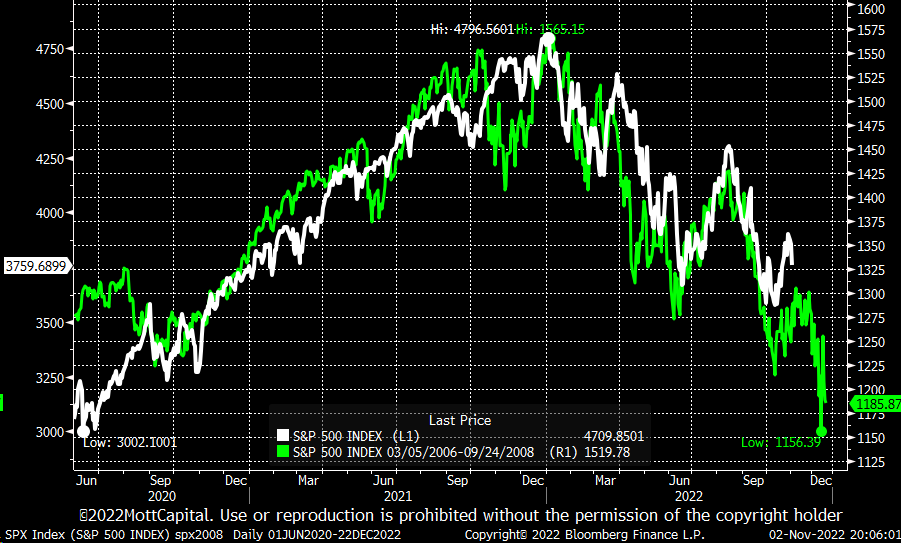

The next 2 months should be interesting. This has a 12 day shift from 2008 to 2022.

Generational theory, international history and current events

https://www.gdxforum.com/forum/

There was a greater reaction than I thought there would be, albeit at the time of writing the US 500 futures are up a bit. Lets seeHiggenbotham wrote: Tue Nov 01, 2022 8:05 pm

I would wait for a continuation of the rally, but if it reverses down I would get out. My interpretation of today's bar is that the market is still in an uptrend. It also appears that the Fed has no intention of upsetting the applecart before the election and the market mostly believes that. That means there will still be a few more buyers if they don't (tomorrow).

I suspect that the Fed has now realised that they have a stubborn inflation problem on their hands, and hence the hawkish tone after yesterdays FOMC meeting.vincecate wrote: Wed Nov 02, 2022 8:58 pm Every month the economists predict inflation will rapidly fall back down to 2% and every month the Fed confidently tells us they have the tools to control inflation. But it does not really look so. Some day people will notice. Next CPI is Nov 10th.

That was pretty much my opinion. I do not know if Bitcoin is the Next Big Thing. I do not know if it is the Scam of the Century. I have only an ECON 101 that is almost half a century old to help me decide. And I do not have a gambling personality.The point of the errors comment of yours, which is good, goes back to my point of making the BIG error. Calling BTC a ponzi and fake, a trap, a dupe, etc. is a BIG categorical error, one that shows you that someone else has major chinks in their thinking armour. I wouldn't say this if all you said (or whomever) was, "BTC is too unknown, too speculative for me, I don't know enough about it, I'm not touching it." That's the classic hubris and ignorance paradigm that most legacy people follow. It's not enough for them to just say, I don't know it, I'm not touching it - it's too risky for me - they disqualify it entirely and make fun of other people. Who know more than they do. Which is the point here.

But the market knows they have always dropped rates at any sign of trouble for the last 40 years, so the market does not reallyrichard5za wrote: Thu Nov 03, 2022 5:08 am I suspect that the Fed has now realised that they have a stubborn inflation problem on their hands, and hence the hawkish tone after yesterdays FOMC meeting.

I don't think any known scam (defrauding investors) lasted 13 years before.Tom Mazanec wrote: Thu Nov 03, 2022 9:23 am That was pretty much my opinion. I do not know if Bitcoin is the Next Big Thing. I do not know if it is the Scam of the Century. I have only an ECON 101 that is almost half a century old to help me decide. And I do not have a gambling personality.

The future of money is certainly digital and data driven. How is the issue as governments will want to have control over their own money to set interest rates, have security, ensure legal operation, etcvincecate wrote: Thu Nov 03, 2022 9:44 amI don't think any known scam (defrauding investors) lasted 13 years before.Tom Mazanec wrote: Thu Nov 03, 2022 9:23 am That was pretty much my opinion. I do not know if Bitcoin is the Next Big Thing. I do not know if it is the Scam of the Century. I have only an ECON 101 that is almost half a century old to help me decide. And I do not have a gambling personality.

Money is sort of a way of keeping score of how much people have put into the system. Fiat money is dishonest, as one special party can print how much ever they want. Bitcoin is honest money. Nobody is special. Over time I expect more and more players to move to the game with the honest score-keeping system. It makes the game more enjoyable.

It also makes it harder for governments to take your wealthy. Also nice.

Again, you mean disinflation. And that then begs the question, what exactly is slowing in its increasing (still) price?richard5za wrote: Thu Nov 03, 2022 5:08 am This makes deflation caused by the inevitable future recession more likely; in my opinion most probable